Commercial Claims Services for Business Recovery

Running a business takes hard work, time, and dedication. But when a disaster strikes, everything you built can be at risk. A fire, a bad storm, or a burst pipe can stop your operations instantly. Damage to your building or inventory can cost a lot of money. This is why business owners trust Palco Claims for expert Commercial Claims Services. When you face property loss, you should not have to fight the insurance company alone.

Business insurance policies are very complex. They are much harder to read than home insurance. Many company owners feel lost when trying to figure out what is covered. Palco Claims steps in to solve this problem through Public Adjusting Services. We act as your commercial public adjuster, working only for you. We do not work for the insurance company. Our job is to make sure you get the fair payment you need to repair your building, replace your stock, and get back to work.

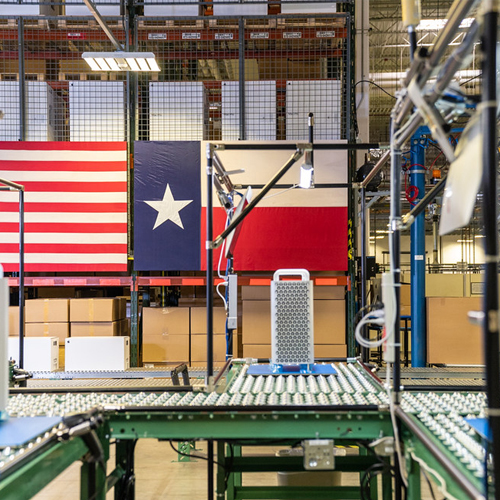

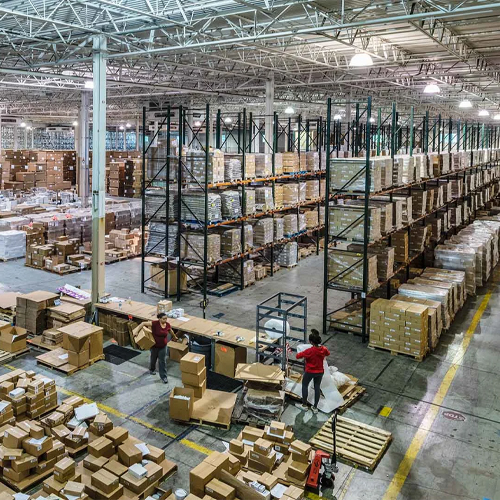

Our team is made up of skilled professionals who know exactly how business claims work. We provide strong support for many types of properties. Whether you need a Texas public adjuster for warehouse operations or help with a retail store, we are ready. If your business has suffered from fire, water, or storm damage, we guide you through every single step.

How We Help With Commercial Insurance Claims

Damage to a business is not just about broken walls or wet floors. It is about lost income and stopped work. Sometimes, the damage is hidden behind walls or under large machines. If these problems are missed, they can cause issues for years. You might need commercial property insurance claim help to find every single issue with a Property Insurance Expert for Hire approach. We look at everything closely to make sure your business is safe.

We explain the entire claims process in simple, plain language. You will never feel left in the dark. Our experts follow all state rules to manage your case correctly. We offer professional help that is designed to protect your business interests.

Checking Every Inch of Damage

The first thing we do is a full inspection of your property. We look at the roof, the structure, the inventory, and the equipment. We check for things that others might miss. For example, smoke can hide in air ducts, or water can damage electrical systems. As a skilled commercial insurance claim adjuster, I write down every detail. This makes sure that your repair plan covers everything you lost, including needs tied to Fire Damage Claims Services.

Building Your Claim File

After the inspection, we create a solid claim file. We list all the damage and explain how it affects your business. We also look at “business interruption,” which is money you lose when you cannot open your doors. We present this clear information to the insurance carrier through Loss Consulting Services style documentation. A well-prepared file stops delays and helps the adjuster see the full picture.

Speaking for Your Business

Talking to insurance companies can be stressful. They often try to pay less than you deserve. We handle all the talking for you. We explain the damage and the costs to the company’s adjuster. We use our knowledge to fight for your rights. This lets you focus on your employees and customers while we handle the hard talks.

Securing a Fair Settlement

The main goal is to get you a fair payment. You need enough money to fix your property correctly. Whether it is a commercial fire damage insurance claim or a loss from a storm, we review every number through Insurance Appraisal Services support. We make sure the offer covers labor, materials, and lost profits. We do not stop until we know you are getting what is fair.

Knowledge of Local Rules

Insurance rules are different in every state. A claim in Texas might have different deadlines than one in another place. Our team knows these local laws inside and out. We use this knowledge to protect your claim as a Public Adjuster in Texas. As a top commercial public adjuster Texas business owners rely on, we make sure no deadline is missed and no rule is broken.

Our Commercial Claims Services Include

Fast Response Teams

When a disaster hits your business, time is money. You need help right away. We send a trained business insurance claim adjuster to your site quickly. Getting help early stops the damage from getting worse. It also helps us gather proof before it is cleaned up or moved.

Complete Loss Evaluation

Storms and fires cause big messes. It can be hard to see what is ruined and what can be saved. We do a deep check of all your assets. This includes the building itself, your furniture, your stock, and your machinery. We provide a full report so the insurance company understands the total value of your loss.

Full Claim Management

We handle the claim from the start to the finish line. You do not have to worry about filling out long forms or answering tricky questions. We provide full support, including specific help like hail damage claim services in Texas. We manage the emails, the calls, and the paperwork. This gives you peace of mind.

Expert Negotiation

Insurance companies have their own adjusters who look out for their profits. You need someone on your side. We negotiate firmly to get you a better offer. If you have a commercial water damage insurance claim, we prove why you need a full replacement instead of a cheap patch through Water Damage Claims Services documentation. We fight to avoid low offers.

Detailed Paperwork Support

To win a claim, you need proof. We gather photos, videos, receipts, and expert reports. We organize all these papers into a strong package. A commercial public adjuster knows exactly what documents the insurance company wants to see. Good records are the key to a fast and fair approval.

Commercial Claims Services by Property Type

Every commercial property runs differently, so claims cannot be handled with one simple template. We review your building type, how you operate daily, and what repairs truly need funding. Then we build a clean, proof-based claim file that insurers can understand.

Industrial Property Claim Help

Big roofs, wide walls, and stored goods can hide storm damage that grows worse later. As your Texas public adjuster for warehouse, we inspect roofing systems, vents, seams, and interior impact so the claim reflects the full loss, not guesses.

For logistics sites, we act as your Texas public adjuster for distribution center and document damage plus operational disruption clearly. Our team organizes photos, notes, and repair scopes in simple language, creating a claim record contractors and carriers trust.

Manufacturing Claims Done Right

Factories have equipment zones and production areas where small damage can stop work fast. As your Texas public adjuster for manufacturing facility, we document building loss and affected areas carefully, so repairs match real operational needs, not surface fixes.

When downtime costs money, proof must be clear and well-timed. We support clean documentation, repair scope clarity, and strong claim organization that improves decisions. Our approach is honest, detailed, and built around real inspections and proper records.

Multifamily Claim Support Fast

Multi-unit properties need careful tracking because one roof leak can affect many rooms and tenants. With Texas apartment building insurance support, we document each impacted area and build a structured claim plan that explains repairs clearly to insurers.

For shared buildings, we also serve as a Texas public adjuster for condominium complex and help separate association areas from unit concerns. Clear documentation reduces disputes, speeds approvals, and supports safer, faster repairs that protect rent income and occupancy.

Retail And Mixed Use

Retail damage can close doors fast and push customers elsewhere. As a Texas public adjuster for retail stores, we document roof leaks, interior damage, and business impact so your claim stays clear, complete, and ready for fair review.

Mixed properties need smart separation of losses across spaces. As a Texas public adjuster for mixed-use buildings, we organize damage by area and coverage type. This reduces confusion, limits delays, and keeps communication simple for owners, managers, and insurers.

Community Care Facility Claims

Some buildings must reopen quickly because people depend on them every day. We support texas public adjuster for hospital and texas public adjuster for medical clinic claims by documenting damage clearly while respecting safety needs and daily operations.

We also handle texas public adjuster for school and texas public adjuster for church claims with care and clear proof. Our team explains steps in easy words, shares updates, and builds claim files that help communities recover faster.

Handling Specific Types of Damage

Storms, fire, and water do not harm businesses in the same way, and insurance claims should never be handled the same way either. We help you understand the damage, collect strong proof, and build clean claim paperwork that supports fair payment for repairs.

Storm And Hail Loss

A sudden Texas storm can turn a normal workday into a costly shutdown within minutes. A commercial storm damage insurance claim must capture roof damage, wall impact, and equipment issues clearly. Our team inspects with care and documents everything step-by-step.

Hail often leaves hidden dents that later become leaks, rust, or weak roof sections. Our hail damage claim services in Texas focus on proof, photos, and repair scope accuracy. When wind causes openings, wind damage claim services in texas document torn materials and storm entry paths.

Fire And Smoke Recovery

Seeing flames is scary, but the real business loss often continues after the fire is out. Our fire and smoke damage claim services in Texas document soot spread, odor problems, and contamination so insurance understands the true level of restoration needed.

Smoke can enter vents, ceilings, and storage rooms, damaging items far from the fire spot. A commercial fire damage insurance claim should include cleaning, deodorizing, rebuilding, and replacement costs. We support organized records that help prevent missed damage and underpayment.

Fast Water Damage Help

One leak can quietly destroy drywall, flooring, and inventory before anyone notices the full impact. A commercial water damage insurance claim needs fast action with clear documentation. We help record moisture damage, source details, and required drying equipment properly.

Water can spread under floors and behind walls, creating long-term mold and repair costs. We build proof-based claim files with photos, notes, and scope lists that insurers understand. This supports full restoration funding instead of temporary fixes that fail later.

Why Choose Palco Claims for Commercial Services?

Deep Experience in Commercial Claims

We are not just home adjusters trying to do business claims. We are true experts. Our team has handled claims for huge factories, busy malls, and local schools. We know the language of business insurance. Whether it is a commercial hail damage insurance claim or a complex fire loss, we have seen it before and solved it.

We Are on Your Side

This is the most important part. We work only for you. The insurance company has people protecting their money. You need someone protecting yours. We care about your business survival. As your commercial public adjuster, we put your needs first, every single time.

Clear and Honest Communication

We do not use confusing legal words. We explain everything in plain English. We give you regular updates so you never have to guess what is happening. We believe that an informed business owner makes better decisions. We tell you the truth about your policy and what to expect.

Maximizing Your Settlement

We dig deep to find every dollar you are owed. We often find damage that the insurance company missed. By looking at everything from fire and smoke damage claim services in Texas to lost profit calculations, we increase the value of your claim. We help businesses get the funds they need to rebuild stronger than before.

Trusted, Ethical Claim Support In Allen, TX

In Allen, some claim companies rush the process and leave homeowners confused. Palco Claims takes a careful approach, so you feel calm, informed, and protected at every step.

In Allen, some claim companies rush the process and leave homeowners confused. Palco Claims takes a careful approach, so you feel calm, informed, and protected at every step.

FREQUENTLY ASKED QUESTIONS

1. What is a commercial claims service?

Commercial claims services help business owners handle insurance claims after damage. This includes inspections, proof collection, paperwork, and talking with the insurer so repairs and payments match real business needs.

2. Why do commercial insurance claims take longer?

Commercial claims often involve large buildings, multiple rooms, equipment, and lost income. More proof is needed, so insurers ask more questions. Good documentation helps reduce delays and confusion.

3. Can Palco Claims help with storm damage claims?

Yes. Many businesses need help after hail or wind events. We organize proof, inspections, and paperwork for a commercial storm damage insurance claim so insurers see full damage, not just surface issues.

4. What damage types do you handle most often?

Most business losses include storm, water, or fire issues. We support claims such as:

- hail

- wind

- water leaks

- fire and smoke

This helps owners recover faster.

5. What is “hidden damage” in commercial claims?

Hidden damage means problems you cannot easily see, like roof bruising, moisture behind walls, or loose flashing. These issues can grow later, so inspection and proof are very important.

6. Do you support warehouse and distribution claims?

Absolutely. Warehouses have big roofs and stored goods that can be ruined fast. We work as a Texas public adjuster for warehouse and distribution center claims, documenting roof loss and interior impacts.

7. How do you help retail stores reopen faster?

Retail owners lose sales when stores close. We document damage clearly, organize repair scope, and speed up claim responses. As a Texas public adjuster for retail store claims, we reduce claim delays.

8. Can you help apartment buildings and condos?

Yes. Multi-unit properties require organized documentation for many areas. We help with texas apartment building insurance and texas public adjuster for condominium complex claims to track damage, repairs, and shared zones.

9. What makes a mixed-use building claim harder?

Mixed-use buildings include homes and business spaces, which may involve different coverage areas. As a Texas public adjuster for mixed-use building claims, we separate losses clearly so nothing is missed.

10. How do you handle fire and smoke losses for businesses?

Fire damage includes smoke, soot, odor, and water from suppression. We document full restoration needs, not only burned spots, through fire and smoke damage claim services in Texas for fair review.

11. What should I do right after commercial damage happens?

First, keep people safe and stop further damage if possible. Then:

- take photos

- save receipts

- avoid throwing items away

Early proof protects your claim greatly.

12. Can you help with commercial water damage insurance claims?

Yes. Water spreads fast and causes mold risks. We support a commercial water damage insurance claim by documenting moisture areas, drying needs, and repair scope so insurers fund proper restoration, not temporary fixes.

13. Will you help if my claim was underpaid?

Yes. Many businesses receive low offers because damage is missed. We review the claim file, find gaps, and add proof so repair costs, equipment impacts, and losses are shown correctly.

14. How do I start a commercial claim consultation?

Getting started is simple. Call Palco Claims or submit the form for a free review. We explain your next steps, answer questions, and guide you toward clear documentation and stronger claim results.